Corpay One

The smartest card for your business

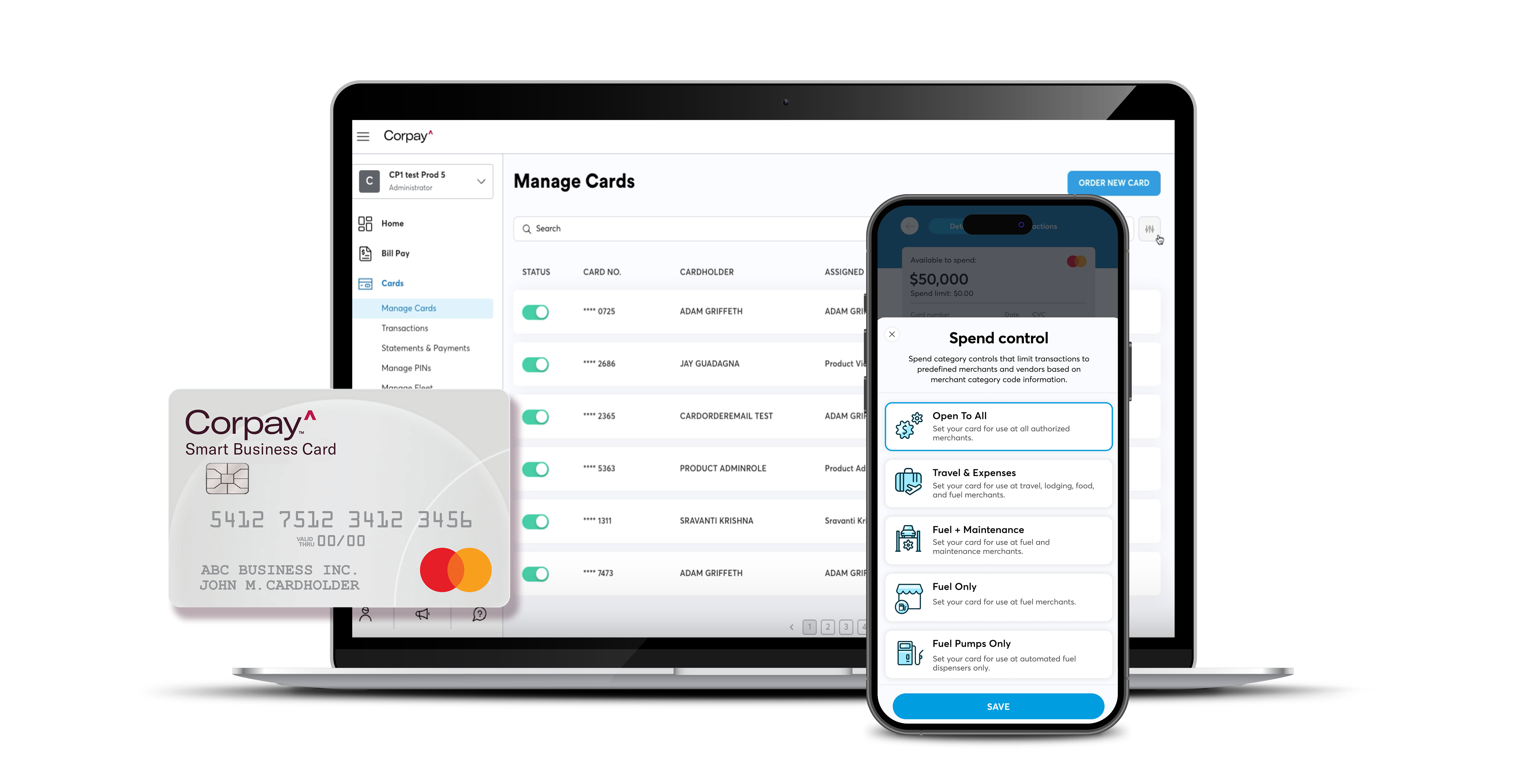

Drive your business forward with one account for fuel cards, business cards, and virtual cards. Corpay One is the smartest way to pay for all your business needs.

Discover which Corpay One card best fits your business

Answer a few brief questions for a card recommendation.

Smarter business payments

Managed with one trusted partner.

FUEL UP AND SAVE

Easily unlock fuel rebates, nationwide acceptance, and more - discover the Fuel Card for your business.

STREAMLINE BUSINESS EXPENSES

Effortlessly manage and save with rebates on your Smart Business Card spend.

PAY VENDORS DIGITALLY

Smarter vendor payments. Securely pay vendors with the Virtual Card and earn even more rebates.

Corpay One is part of Corpay, a global S&P 500 corporate payments company that helps businesses pay expenses in a simple, controlled manner.

#1

B2B Mastercard® issuer in North America

10B+

Annual fuel gallons

800K+

Business clients

$145B

Annual spend processed

1M+

Vendors in merchant network

$800M+

Rebates paid to customers yearly

All the smarter ways to pay

Stack your savings with market-leading rebates1

What customers have to say about Corpay One

Need Help? Let's Talk!

Our team of specialists is here to help you select the best product for your business and learn more about Corpay One.

Tell us a little bit about yourself in this form and a member of our team will be in touch soon.